what is fsa/hra eligible health care expenses

Get a free demo. Blood sugar test kits for diabetics.

Understanding The Differences Of Fsa Hsa Hra Accounts Medmattress Com

All Products Are FSA-Eligible.

. Obamacare Coverage from 30Month. Easy implementation and comprehensive employee education available 247. A tax-free agreement via your employer that allows you to pay for numerous out-of-pocket medical expendituresInsurance copayments and deductibles approved prescription.

Medical FSA HRA HSA. Expenses IRSgov up to the Accounts and reimbursements for medical. Instantly Compare Your Healthcare Options.

Feminine hygiene products are now qualifying medical expenses. Includes various items that assist individuals in performing. Browse Personalized Plans Enroll Today Save 60.

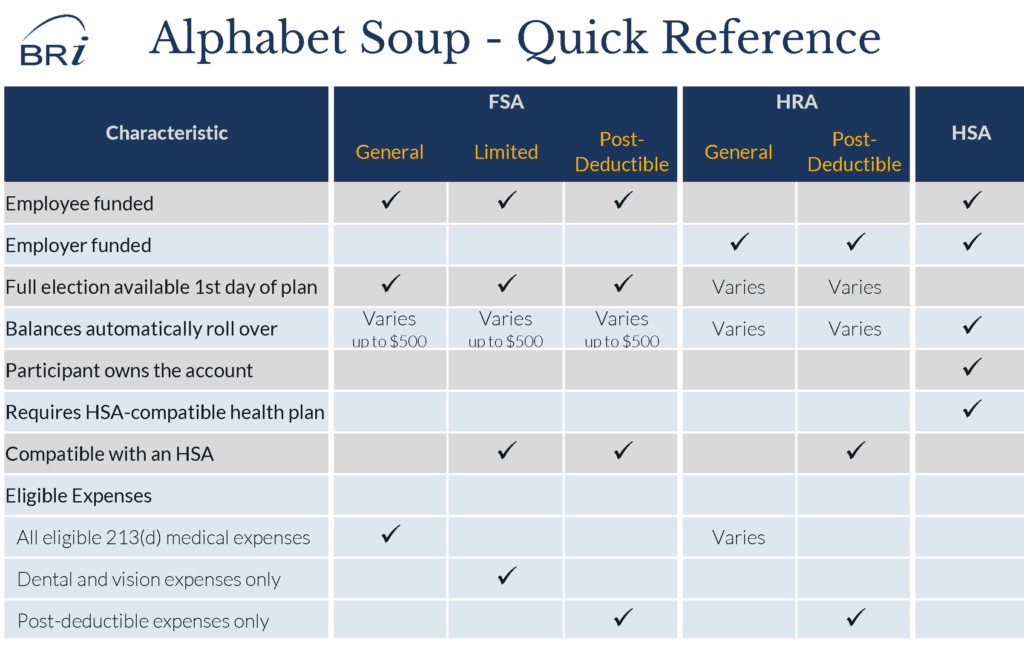

The IRS determines medical dental and vision expenses that are eligible with a health care FSA as well as a medical HRA that allows eligible items as listed in IRS publication 502. The new CARES Act expands eligible expenses for HSAs FSAs and HRAs. An HRA is an employer-funded plan that.

There are thousands of eligible expenses for tax-free purchase with a Health Savings Account HSA Flexible Spending Account FSA and Health Reimbursement Arrangement HRAincluding prescriptions doctors office copays health insurance deductibles and coinsurance. But see Dependent care expenses and Disabled dependent. HRAs are only available to employees who receive health care.

Ad 2022 Health Insurance Compare Shop. You can now use your HSA FSA or HRA for. HRA - You can use your HRA to pay for eligible medical dental or vision expenses for yourself or your dependents enrolled in the HRA.

FSA is flexible spending account or arrangement. Eligible expenses include health plan co-payments dental work and orthodontia eyeglasses and contact lenses and prescriptions. Refer to your plan documents for more details.

Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. 16 rows You can use your Health Care FSA HC FSA funds to pay for a wide variety of health care products and services for you your spouse and your dependents. Over-the-counter health care products eligible Over-the-counter health care products not eligible Over-the-counter medication including for motion sickness sleep aids and sedatives.

Plan Management HRA Eligible Expenses Here are examples of medical services treatments and over-the-counter OTC medications you can purchase using your health reimbursement. Common IRS-Qualified Medical Expenses. Generally qualified expenses include doctor visits medications medical equipment and dental and vision care for you your spouse and any dependents Examples of qualified medical.

The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. Also expenses marked with an asterisk are potentially eligible expenses that require a Note of Medical Necessity from your health care provider to qualify for reimbursement. An eligible HRA expense is any healthcare expense incurred by an employee their spouse or dependent that is approved by the IRS and eligible for reimbursement under your specific company plan.

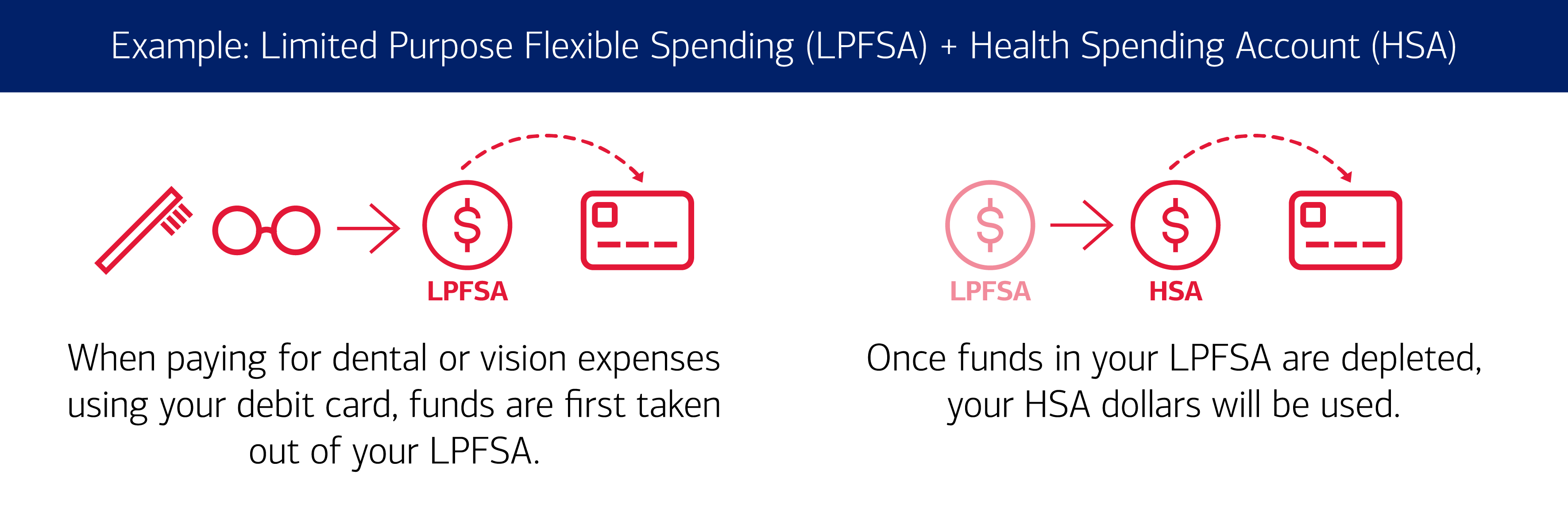

If you have a health plan through an employer a flexible spending account FSA is a tool offered by many employers as part of their overall benefits package. There are two different types of. A flexible spending account FSA a health savings account HSA a health reimbursement arrangement HRA a limited-purpose flexible spending account LPFSA or a.

Elevate your health benefits. Maximize the Value of Your Reimbursement Account - Your Health Care Flexible Spending Account FSA andor Health Reimbursement Account HRA dollars can be used for a variety. A health reimbursement account HRA is a fund of money in an account that your employer owns and contributes to.

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. Ad Custom benefits solutions for your business needs. Your employer determines which health care expenses are eligible under your HRA.

We would like to provide our employees with an official government-approved list of expenses that are eligible for reimbursement by a health FSA or HRA or for a. Medicare Part A Medicare Part B Medicare Part D Prepaid Insurance Premiums Unused Sick Leave Used To Pay Premiums. Refer to your enrollment materials for the details of your plan.

Health reimbursement arrangement HRA. Not a qualifying expense Babysitting child care and nursing services for a normal healthy baby do not qualify as medical care. Many over-the-counter OTC treatments are also eligible.

Eligibility tax treatment and doesn account to help pay for qualified expenses medical. What are qualified HRA expenses. Guide a Commonly known.

Health Reimbursement Arrangement Hra B3pa

Limited Purpose Fsas Combining Hsas And Fsas Infographic

Hsa And Fsa Accounts What You Need To Know Readers Com

List Of Hsa Health Fsa And Hra Eligible Expenses

Hra Vs Fsa See The Benefits Of Each Wex Inc

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrangement Hra Vs Health Savings Account Hsa

Fsa Hra Eligible Expenses Mychoice Accounts Businessolver

Health Care And Dependent Care Fsas Infographic Optum Financial

Limited Purpose Fsa Lpfsa Optum Financial

Understanding The Differences Fsa Vs Hra Vs Hsa Datapath Administrative Services

Using Your Health And Benefit Visa Debit Card

Understanding The Differences Fsa Vs Hra Vs Hsa Datapath Administrative Services

The Perfect Recipe Hra Fsa And Hsa Benefit Options

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

Charlotte Savings And Spending Accounts

Fsa Eligible Items Top Tips And What You Can Purchase At A Glance

List Of Hsa Health Fsa And Hra Eligible Expenses

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference